Secondary Navigation

- Plan Would Abolish New York City Personal Income Taxes for More Than 429,600 Filers and Dependents, Lower Taxes for Over 152,500 More

- Axe the Tax Plan Follows Historic Expansion of NYC EITC, Which, Together With New Proposal, Would Deliver Collective $408 Million in Tax Relief to 2 Million New Yorkers

Mayor Adams Leads Rally Thanking State Partners for Supporting "Axe the Tax for the Working Class," Bold Proposal to Eliminate and cut City Taxes for Over 582,000 New Yorkers and Dependents

March 31, 2025

Watch the video here at https://www.youtube.com/watch?v=0RDmkQ7_eMo

Plan Would Abolish New York City Personal Income Taxes for More Than

429,600 Filers and Dependents, Lower Taxes for Over 152,500 More

Axe the Tax Plan Follows Historic Expansion of NYC EITC, Which, Together With

New Proposal, Would Deliver Collective $408 Million in Tax Relief to 2 Million New Yorkers

Rally Follows Inclusion of Mayor Adams’ Axe the Tax Plan in FY26 State Budget,

Highlights Adams Administration’s Efforts to Make New York City Best Place to Raise a Family

NEW YORK – New York City Mayor Eric Adams today led a rally at City Hall celebrating the inclusion of his “Axe the Tax for the Working Class” proposal in the Fiscal Year 2026 New York state budget and thanking state partners, labor unions, and nonprofit advocates for their support. The ambitious proposal will bring significant tax relief to working-class families by eliminating and cutting city personal income taxes for more than 582,000 filers and their dependents. First announced in December 2024 with the support of New York State Senator Leroy Comrie and New York State Assemblymember Rodneyse Bichotte Hermelyn, the plan would return over $63 million to New Yorkers by eliminating the New York City Personal Income Tax for filers with dependents living at or below 150 percent of the federal poverty line, as well as lowering city personal income taxes for filers with dependents immediately above that threshold too. If enacted, Axe the Tax for the Working Class could bring relief to working-class families as soon as tax year 2025 and help strengthen the Adams administration’s efforts to make New York City the best place to raise a family.

“If there is one thing New Yorkers can agree on, it’s that the cost of living in this city is too damn high, especially for working-class New Yorkers. Rent, food, gas, child care, cable — it adds up, and it’s too much. Extreme costs are driving too many families — especially working-class families — out of cities like New York, which is why our administration is working to help New Yorkers save money every day,” said Mayor Adams. “Our ‘Axe the Tax’ plan will take that work to the next level and give tens of millions of dollars back to the families who need it most. Thank you to the coalition of leaders and advocates who have supported this proposal and fought to give working-class New Yorkers the relief they deserve.”

Axe the Tax for the Working Class would eliminate New York City Personal Income Taxes for filers with dependents — largely families with children — living at or below 150 percent of the federal poverty line. Additionally, the proposal would gradually phase out the New York City Personal Income Tax for filers whose income is immediately above — within $5,000 — of 150 percent of the federal poverty line.

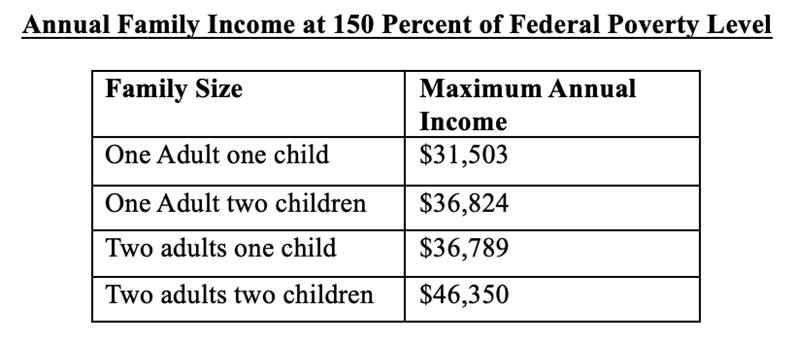

Table for illustrative purposes showing maximum annual income for different family sizes at 150 percent of the of the current U.S. Census Bureau's Official Poverty Measure. Data for larger family sizes can be found online.

By eliminating the New York City Personal Income Tax for working-class families, the proposal would return nearly $46 million to over 429,000 New Yorkers, including both tax filers and their dependents. Additionally, by lowering taxes for people immediately above 150 percent of the federal poverty line, the proposal would return another $17 million to over 152,500 New Yorkers and their dependents, putting more than a collective $63 million back into the pockets of working-class New Yorkers. The proposal alone will deliver an average benefit of approximately $350 per household.

Axe the Tax for the Working Class builds on the Adams administrations’ continued efforts to help put money back into the pockets of working-class New Yorkers. In 2022, Mayor Adams successfully pushed Albany to expand the New York City Earned Income Tax Credit (NYC EITC) for the first time in nearly two decades, delivering more than $345 million in tax relief to New Yorkers over the 2023 tax season, at an average of approximately $450 per household. When combined, both Axe the Tax for the Working Class and the new, enhanced NYC EITC would put more than a collective $408 million back into the pockets of 2 million New Yorkers — providing an average benefit of approximately $800 per household — and effectively eliminating New York City income taxes for a family of four making less than $46,350.

Table showing possible tax relief for New York City families from both Enhanced NYC EITC as well as Axe the Tax for the Working Class.

The Adams administration has already saved New Yorkers more than $30 billion by connecting local residents to city, state, and federal programs, including a historic expansion of the NYC EITC. Since the start of the Adams administration, the New York City Department of Consumer and Worker Protection’s (DCWP) “NYC Free Tax Prep” program has helped New Yorkers save nearly $57 million in tax preparation fees by helping filers file approximately 257,000 tax returns for free. NYC Free Tax Prep providers also offered drop-off services and virtual tax preparation services. In fall 2023, DCWP launched NYC Free Tax Prep for self-employed filers, offering specialized services tailored to gig workers, freelancers, and small business owners who often face barriers to filing taxes and managing financial recordkeeping.

“With the state budget process edging closer to completion, Mayor Adams’ Axe the Tax for the Working Class initiative will provide much-needed relief to thousands of hardworking New Yorkers, ensuring they can keep more of their earnings to support their families," said New York Senator Leroy Comrie. "This effort will not be possible without the dedication of our state partners, organized labor, and nonprofit advocates who are fighting tirelessly to make this vision a reality. By eliminating and reducing the city’s personal income tax for those most in need, we are taking a critical step toward making New York City more affordable and livable. I am proud to have championed this initiative being included in the budget alongside my colleague Assemblywoman Rodneyse Bichotte-Hermelyn, and I look forward to seeing the positive impact it will have on our communities.”

“I appreciate the efforts of Mayor Adams and my colleagues in government for working to provide tax relief for the middle class. This kind of Personal Income Tax relief is not just a financial necessity, but also demonstrates a commitment to the hardworking families who are the backbone of our economy,” said New York State Senator Joseph P. Addabbo Jr. “I believe the effects of Axe the Tax would have a positive direct impact in helping individuals struggling to pay for health care, groceries, rent, rising insurance premiums, property taxes and costs associated with everyday life. I remain hopeful we can implement this tax relief properly for the benefit of our residents.”

“By eliminating and reducing the city personal income tax for over half a million New Yorkers, we are providing real relief to those who are working hard to make ends meet,” said New York State Assemblymember Rodneyse Bichotte Hermelyn. “The inclusion of Mayor Adams’ Axe the Tax for the Working Class proposal in our state FY26 budget is a major victory for all New Yorkers and a critical step toward easing the financial burden on families who need it most. I’m committed to making New York City more affordable, and that’s why I first co-sponsored this legislation to ‘Axe the Tax for the Working Class’ with Senator Leroy Comrie. I thank Mayor Adams, my legislative colleagues, and our partners in organized labor for standing together to prioritize ensuring New York City remains a welcoming home where every family can thrive.”

“We are laser-focused on uplifting all New Yorkers in economic distress. Axe the Tax will eliminate city income taxes for over 400,000 New Yorkers and slash them for another 150,000. Combined with the EITC I helped expand in Albany, we will put almost half a billion dollars back in the pockets of two million New Yorkers,” said New York State Assemblymember Jenifer Rajkumar. “At a time when one in four New Yorkers is in poverty, and we are all feeling the squeeze of inflation, this tax relief will serve as a vital lifeline for families to put food on the table and have a roof over their heads. Together, we are committed to forging a path to economic security for all New Yorkers, allowing everyone to grow and thrive.”

“The passage of Axe the Tax for the Working Class would provide significant tax relief, putting money back into the pockets of hardworking New Yorkers,” said New York State Assemblymember Nikki Lucas. “As the assemblywoman for the 60th District, I can say that this would benefit many of my constituents, allowing families to better meet their basic needs and create more opportunities to save for their future.”

“New Yorkers work hard every day to support their families, yet too many are still struggling under the weight of high living costs. Mayor Adams’ Axe the Tax proposal is a bold and necessary step to put real money back into the pockets of working-class families. By eliminating or reducing the city’s personal income tax for hundreds of thousands of New Yorkers, this plan will ease financial burdens and help families afford essentials like housing, child care, and groceries,” said New York State Assemblymember Alicia Hyndman. “As we continue fighting for economic fairness, I look forward to working with my colleagues in Albany to pass this critical relief and ensure our families can thrive in the city they call home.”

“Hardworking New Yorkers, including the hospitality workers we represent, deserve a city that prioritizes their financial well-being. While our members are able to band together to fight for living wages and quality benefits, tens of thousands of workers earning minimum wage continue to struggle to keep a roof over their heads and food on the table. ‘Axe the Tax for the Working Class’ is a meaningful step towards providing much needed-relief for working families, helping them keep more of their hard earned wages,” said Rich Maroko, president, Hotel and Gaming Trades Council. “The Hotel & Gaming Trades Council is proud to stand with Mayor Adams and our partners in Albany as we work to make New York City a more affordable place to live and work, and we look forward to getting this across the finish line.”

“The New Yorkers who power our city’s economy are facing an affordability crisis, and that’s why my union supports the ‘Axe the Tax for the Working Class’ proposal,” said Stuart Appelbaum, president, Retail, Wholesale and Department Store Union (RWDSU). “This common-sense solution will put money back into the pockets of RWDSU members and working-class families who need a boost in these tough economic times. We urge lawmakers to listen to working people and Axe the Tax in this year’s New York state budget.”

“As the leader of the largest provider of shelter for families with children in the nation, I see the affordability crisis play out every single day. New York City has been a place where families could get ahead and achieve the American dream. We cannot turn our backs on that legacy,” said Christine C. Quinn, president and CEO, Win Inc. “Axe the Tax for the Working Class is a serious, substantive policy that will give hundreds of dollars back to those who need it most and help deliver the long-overdue relief that New Yorkers require. WIN is grateful to the Adams administration, and our state partners for their leadership, and together, let’s Axe the Tax for the Working Class.”

“At a time when the pocketbooks of low-income New Yorkers are already strained, the Axe the Tax brings welcome relief to families”, said David R. Jones, president and CEO, Community Service Society of New York. “When this effort is combined with other holistic investments in housing, 3-K and Pre-K, expanded Fair Fares, and improved access to benefits, we would be making the city a welcome and affordable place for all New Yorkers.”

###

Media Contact

pressoffice@cityhall.nyc.gov

(212) 788-2958