NYC DEP Infuses $165 Million Into Nine Hudson Valley and Catskills Counties In 2024

January 22, 2025

DEP remains top taxpayer in Ulster, Putnam, Schoharie and Delaware counties; second highest taxpayer in Westchester for 2024

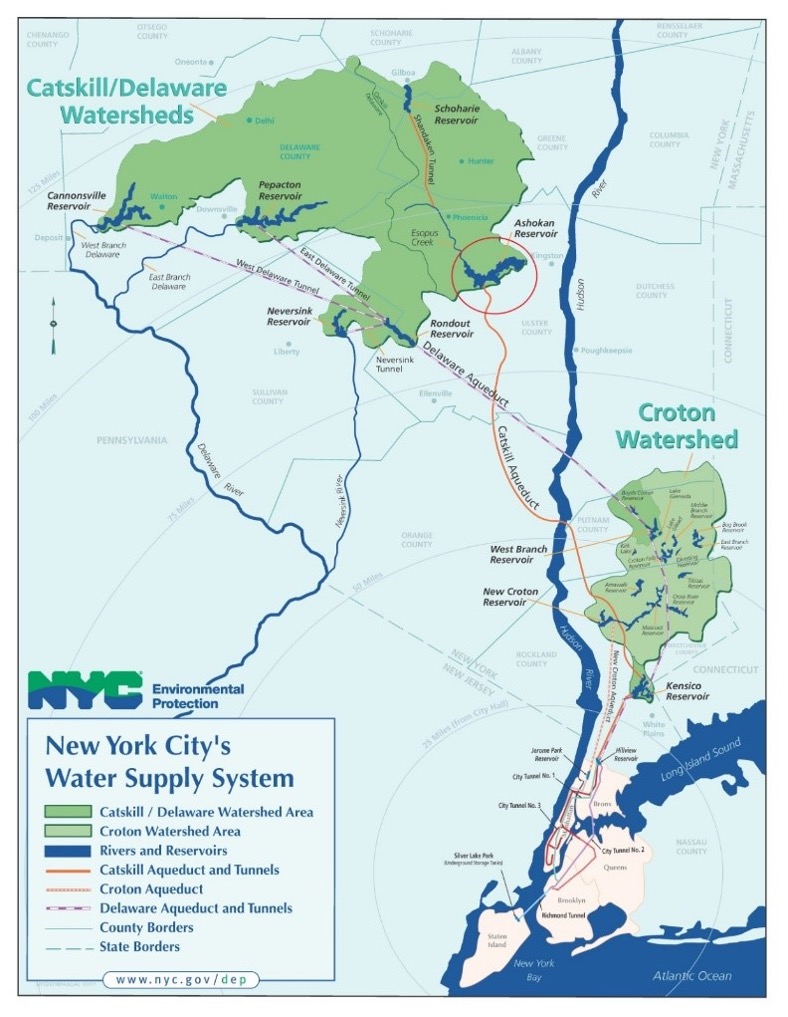

The New York City Department of Environmental Protection (DEP) announced today completing payments of $165 million in local village, town, city, county and school taxes in 2024 across nine Hudson Valley and Catskill counties covering the water supply system serving half of the State’s population. With these payments, DEP remains a top taxpayer throughout many municipalities and school districts in and near the watershed, paying taxes on the full-assessed value of land, structures, easements and most water supply infrastructure across the more than 200,000 acres owned by New York City for the water supply system.

“DEP remains committed to working hand in hand with all the communities that help us continually delivering the highest quality water possible to half the State’s population,” said DEP Commissioner Rohit T. Aggarwala. “Between paying full property taxes, funding best management practices on watershed farms and economic development projects throughout the region, DEP directly infuses hundreds of millions of dollars each year to local economies throughout the watershed and will continue paying its fair share to support our community partners.”

DEP pays property and school taxes at full assessed value on all land, reservoirs, dams and structures across the approximately 230,000 acres it owns or controls throughout the 2,000-square-mile watershed in the Hudson Valley and Catskills, including the tens of thousands of acres open to the public for recreational purposes such as hiking, fishing, hunting and boating, as well as on property used for agricultural purposes. Piping and aqueducts used to convey water are tax exempt. Taxes are paid on all properties originally acquired to build the 19 upstate reservoirs and three controlled lakes between the mid-19th and mid-20th centuries (about 78,000 acres), and all land and assets acquired since to operate the supply system and as buffer land to help protect water quality (approximately 156,000 acres).

In 2024, DEP was among the top taxpayers in numerous municipalities and school districts across the watershed region. DEP paid more county government property taxes than any other property owner in Ulster, Delaware, Putnam and Schoharie counties, and was the second highest in Westchester County.

DEP also has more than 1,000 employees throughout the upstate watershed and water supply system.

“Most DEP employees assigned to facilities throughout the Catskills and Hudson Valley also call the region home and infuse millions more into the local economies by shopping, raising families and paying taxes as well. For us, working with these communities is not simply a business decision born from necessity but a personal one where we truly get to work hand in hand with our neighbors,” said DEP Deputy Commissioner Paul V. Rush of the Bureau of Water Supply.

The DEP’s 2024 local property and school tax payments breakdown as follows:

Delaware County

On 1,231 parcels, DEP paid $6,460,574 in county property taxes and $12,537,575 in school taxes.

- Town of Colchester – on 36 parcels, DEP paid $1,959,443 in town property taxes.

- Town of Deposit – on 1 parcel, DEP paid $658,172 in town property taxes.

- Town of Tompkins – On 68 parcels, DEP paid $586,315 in town property taxes.

- Town of Middletown – On 178 parcels, DEP paid $467,511 in town property taxes.

- Town of Roxbury – On 208 parcels, DEP paid $415,249 in town property taxes.

- Town of Andes – On 188 parcels, DEP paid $388,082 in town property taxes.

- Town of Walton – On 72 parcels, DEP paid $81,686 in town property taxes.

- Town of Delhi – On 95 parcels, DEP paid $91,353 in town property taxes.

- Town of Bovina – On 50 parcels, DEP paid $67,175 in town property taxes.

- Town of Hamden – On 86 parcels, DEP paid $36,363 in town property taxes.

- Town of Kortright – On 61 parcels, DEP paid $35,279 in town property taxes.

- Town of Stamford – On 106 parcels, DEP paid $29,534 in town property taxes.

- Town of Meredith – On 42 parcels, DEP paid $22,306 in town property taxes.

- Town of Masonville – On 14 parcels, DEP paid $11,657 in town property taxes.

- Town of Franklin – On 18 parcels, DEP paid $10,982 in town property taxes.

- Town of Harpersfield – On 7 parcels, DEP paid $2,340 in town property taxes.

- Town of Hancock – On 1 parcel, DEP paid $772 in town property taxes.

Dutchess County

On 39 parcels, DEP paid $47,253 in county property taxes and $434,432 in school taxes.

- Town of East Fishkill – On 32 parcels, DEP paid $68,733 in town property taxes.

- Town of Wappinger – On 4 parcels, DEP paid $6,104 in town property taxes.

- Town of Beekman – On 1 parcel, DEP paid $1,714 in town property taxes.

- Town of Fishkill – On 2 parcels, DEP paid $2,088 in town property taxes.

Greene County

On 458 parcels, DEP paid $529,591 in county property taxes and $1,248,072 in school taxes.

- Town of Hunter – On 80 parcels, DEP paid $179,089 in town property taxes.

- Town of Windham – On 120 parcels, DEP paid $74,292 in town property taxes.

- Town of Jewett – On 69 parcels, DEP paid $57,365 in town property taxes.

- Town of Lexington – On 58 parcels, DEP paid $62,136 in town property taxes.

- Town of Prattsville - On 50 parcels, DEP paid $82,272 in town property taxes.

- Town of Ashland - On 54 parcels, DEP paid $55,530 in town property taxes.

- Town of Halcott – On 27 parcels, DEP paid $20,543 in town property taxes.

Sullivan County

On 131 parcels, DEP paid $4,149,122 in county property taxes and $10,240,494 in school taxes.

- Town of Neversink – On 117 parcels, DEP paid $3,840,180 in town property taxes.

- Town of Fallsburg – On 11 parcels, DEP paid $10,238 in town property taxes.

- Town of Rockland – On 3 parcels, DEP paid $1,377 in town property taxes.

Ulster County

On 558 parcels, DEP paid $3,895,152 in county property taxes and $18,152,546 in school taxes.

- Town of Wawarsing – On 80 parcels, DEP paid $2,691,490 in town property taxes.

- Town of Olive – On 142 parcels, DEP paid $2,010,790 in town property taxes.

- Town of Hurley – On 26 parcels, DEP paid $692,437 in town property taxes.

- Town of Shandaken – On 90 parcels, DEP paid $519,815 in town property taxes.

- Town of Marbletown – On 11 parcels, DEP paid $123,939 in town property taxes.

- Town of Woodstock – On 108 parcels, DEP paid $96,535 in town property taxes.

- City of Kingston – On 3 parcels, DEP paid $74,111 in municipal property taxes.

- Town of Denning – On 74 parcels, DEP paid $33,041 in town property taxes.

- Town of Shawangunk – On 1 parcels, DEP paid $7,245 in town property taxes.

- Town of Gardiner – On 1 parcels, DEP paid $1,937 in town property taxes.

- Town of New Paltz – On 2 parcels, DEP paid $7,395 in town property taxes.

- Town of Hardenburgh – On 15 parcels, DEP paid $8,299 in town property taxes.

- Town of Rochester – On 2 parcels, DEP paid $458 in town property taxes.

- Town of Plattekill – On 2 parcels, DEP paid $731 in town property taxes.

- Town of Kingston – On 1 parcels, DEP paid $1,109 in town property taxes.

Orange County

On 21 parcels, DEP paid $12,504 in county property taxes and $88,757 in school taxes.

- Town of New Windsor – On 4 parcels, DEP paid $14,652 in town property taxes.

- Town of Newburgh – On 10 parcels, DEP paid $7,882 in town property taxes.

- Town of Montgomery – On 5 parcels, DEP paid $1,640 in town property taxes.

- Town of Cornwall – On 2 parcels, DEP paid $580 in town property taxes.

Putnam County

On 484 parcels, DEP paid $2,015,384 in county property taxes and $17,672,085 in school taxes.

- Town of Carmel – On 130 parcels, DEP paid $2,0104,217 in town property taxes.

- Town of Southeast – On 24 parcels, DEP paid $887,281 in town property taxes.

- Town of Kent – On 297 parcels, DEP paid $1,009,405 in town property taxes.

- Town of Putnam Valley – On 12 parcels, DEP paid $33,287 in town property taxes.

- Town of Philipstown – On 21 parcels, DEP paid $23,039 in town property taxes.

Schoharie County

On 101 parcels, DEP paid $2,525,734 in county property taxes and $3,182,887 in school taxes.

- Town of Gilboa - On 31 parcels, DEP paid $969,262 in town property taxes.

- Town of Conesville - On 62 parcels, DEP paid $40,556 in town property taxes.

- Town of Jefferson - On 8 parcels, DEP paid $9,574 in town property taxes.

Westchester County

On 501 parcels, DEP paid $7,183,385 in county property taxes and $41,711,473 in school taxes.

- Town of Mount Pleasant – On 39 parcels, DEP paid $5,590,361 in town property taxes.

- Town of North Castle – On 56 parcels, DEP paid $2,085,772 in town property taxes.

- Town of Cortlandt – On 29 parcels, DEP paid $1,402,547 in town property taxes.

- Town of North Salem – On 24 parcels, DEP paid $755,851 in town property taxes.

- City of Yonkers – On 16 parcels, DEP paid $132,345 in municipal property taxes.

- Town of Bedford – On 36 parcels, DEP paid $555,894 in town property taxes.

- Town of Somers – On 21 parcels, DEP paid $291,243 in town property taxes.

- Town of Yorktown – On 180 parcels, DEP paid $163,815 in town property taxes.

- Town of Greenburgh – On 25 parcels, DEP paid $265,126 in town property taxes.

- Town of Lewisboro – On 28 parcels, DEP paid $117,859 in town property taxes.

- Town of Harrison – On 10 parcels, DEP paid $186,754 in town property taxes.

- Town of New Castle – On 31 parcels, DEP paid $56,137 in town property taxes.

- Town of Pound Ridge – On 3 parcels, DEP paid $5,988 in town property taxes.

- Town of Ossining – On 3 parcels, DEP paid $3,260 in town property taxes.

| School District | School Tax |

|---|---|

| Andes | $632,393 |

| Ardsley | $25,060 |

| Arlington | $16,940 |

| Beacon | $18,484 |

| Bedford | $110,004 |

| Brewster | $5,968,877 |

| Briarcliff Manor | $8,736 |

| Byram Hills | $2,169,176 |

| Carmel | $5,695,984 |

| Chappaqua | $212,702 |

| Cornwall | $2,699 |

| Croton-Harmon | $7,365,974 |

| Delhi | $396,171 |

| Deposit | $2,847,851 |

| Downsville | $5,852,695 |

| Edgemont | $102,857 |

| Ellenville | $9,306,113 |

| Elmsford | $68,630 |

| Franklin | $6,370 |

| Garrison | $24,771 |

| Gilboa-Conesville | $3,320,532 |

| Greenburgh | $91,943 |

| Haldane | $42,169 |

| Hancock | $1,621 |

| Harrison | $433,006 |

| Hastings-on-Hudson | $2,238 |

| Hendrick Hudson | $560 |

| Hunter-Tannersville | $758,040 |

| Jefferson | $19,161 |

| Katonah-Lewisboro | $2,492,764 |

| Kingston | $174,726 |

| Lakeland | $59,669 |

| Liberty | $2,091 |

| Livingston Manor | $6,710 |

| Mahopac | $5,296,835 |

| Margaretville | $924,665 |

| Marlboro | $23,591 |

| Mount Pleasant | $2,082,394 |

| New Paltz | $15,032 |

| Newburgh | $26,129 |

| North Salem | $4,010,215 |

| Onteora | $7,846,669 |

| Ossining | $18,122 |

| Pleasantville | $126,963 |

| Pocantico Hills | $7,497,401 |

| Putnam Valley | $38,905 |

| Rondout Valley | $626,522 |

| Roscoe | $1,151 |

| Roxbury | $796,885 |

| Sidney | $19,001 |

| Somers | $1,984,160 |

| South Kortright | $180,692 |

| Stamford | $35,922 |

| Tarrytown | $24,032 |

| Tri-Valley | $10,360,316 |

| Valhalla | $10,411,239 |

| Valley | $11,746 |

| Wallkill | $51,415 |

| Walton | $841,258 |

| Wappingers | $5,174 |

| Washingtonville | $24,592 |

| Windham-Ashland-Jewett | $337,569 |

| Yonkers | $2,672,548 |

| Yorktown | $739,458 |

| Report Totals | $105,268,320 |