Consumer and Worker Protection311

Consumer and Worker Protection311 Search all NYC.gov websites

Search all NYC.gov websites

Research

Impact of the Enhanced New York City Earned Income Tax Credit

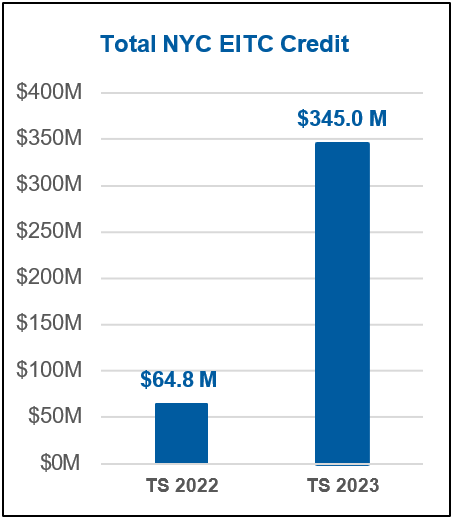

After being expanded for the first time in nearly 20 years, the enhanced NYC Earned Income Tax Credit (EITC) helped more than 746,000 New Yorkers in the 2023 tax season. DCWP’s study found that the enhanced credit put $345 million back into the pockets of New Yorkers living in some of the lowest income communities in the city, up an additional $280 million from the previous tax season.

Download research brief

After being expanded for the first time in nearly 20 years, the enhanced NYC Earned Income Tax Credit (EITC) helped more than 746,000 New Yorkers in the 2023 tax season. DCWP’s study found that the enhanced credit put $345 million back into the pockets of New Yorkers living in some of the lowest income communities in the city, up an additional $280 million from the previous tax season.

Download research brief

Restaurant Delivery App Data

Restaurant Delivery Apps are required to submit monthly reports to DCWP. DCWP analyzes the data as part of its monitoring of compliance with the minimum pay rate. The inaugural quarterly report reveals that worker pay is significantly higher, impacts on the restaurant industry have been minimal, and the demand for app-based food delivery remains strong.

Download Restaurant Delivery App Data: January-March 2024

Restaurant Delivery Apps are required to submit monthly reports to DCWP. DCWP analyzes the data as part of its monitoring of compliance with the minimum pay rate. The inaugural quarterly report reveals that worker pay is significantly higher, impacts on the restaurant industry have been minimal, and the demand for app-based food delivery remains strong.

Download Restaurant Delivery App Data: January-March 2024

Where Are the Unbanked in NYC? | Updated Findings (2021 Data)

Every two years, DCWP estimates the unbanked in NYC. The research brief illustrates the updated number of unbanked households in NYC (an estimated 305,700 NYC households), details demographic information about the unbanked population, and highlights systemic barriers to banking access.

Download research brief

Every two years, DCWP estimates the unbanked in NYC. The research brief illustrates the updated number of unbanked households in NYC (an estimated 305,700 NYC households), details demographic information about the unbanked population, and highlights systemic barriers to banking access.

Download research brief

Neighborhood Financial Health Digital Mapping and Data Tool

Our Neighborhood Financial Health (NFH) Digital Mapping and Data Tool provides neighborhood financial health indicator data for every neighborhood in New York City. OFE also developed the NFH Index to present patterns in the data within and across neighborhoods. NFH Index scores describe relative differences between neighborhoods across the same indicators; they do not evaluate neighborhoods against fixed standards. New data found that though improved, the conditions that promote New Yorkers’ financial health are still disproportionately concentrated among relatively few neighborhoods. Understanding these connections is potentially useful for uncovering systems that perpetuate the racial wealth gap, an issue with direct implications for OFE’s mission to expand asset building opportunities for New Yorkers with low and moderate incomes. The latest data set continued to show that neighborhood financial health outcomes are starkly different across racial and ethnic groups.

View digital mapping and data tool

Our Neighborhood Financial Health (NFH) Digital Mapping and Data Tool provides neighborhood financial health indicator data for every neighborhood in New York City. OFE also developed the NFH Index to present patterns in the data within and across neighborhoods. NFH Index scores describe relative differences between neighborhoods across the same indicators; they do not evaluate neighborhoods against fixed standards. New data found that though improved, the conditions that promote New Yorkers’ financial health are still disproportionately concentrated among relatively few neighborhoods. Understanding these connections is potentially useful for uncovering systems that perpetuate the racial wealth gap, an issue with direct implications for OFE’s mission to expand asset building opportunities for New Yorkers with low and moderate incomes. The latest data set continued to show that neighborhood financial health outcomes are starkly different across racial and ethnic groups.

View digital mapping and data tool

A Minimum Pay Rate for App-Based Restaurant Delivery Workers in NYC

DCWP released a report on pay and working conditions of app-based restaurant delivery workers in New York City and the proposed effects of its proposed minimum pay rate. The report summarizes results from DCWP’s study of app-based restaurant delivery workers in New York City. The report draws from data obtained from restaurant delivery apps, surveys distributed to delivery workers and restaurants, testimony from DCWP’s public hearing, extensive discussions with stakeholders and publicly available data

Download report

DCWP released a report on pay and working conditions of app-based restaurant delivery workers in New York City and the proposed effects of its proposed minimum pay rate. The report summarizes results from DCWP’s study of app-based restaurant delivery workers in New York City. The report draws from data obtained from restaurant delivery apps, surveys distributed to delivery workers and restaurants, testimony from DCWP’s public hearing, extensive discussions with stakeholders and publicly available data

Download report

DCWP began enforcing the minimum pay rate on December 4, 2023. Learn more about how DCWP analyzes restaurant delivery app data to monitor compliance with the minimum pay rate at nyc.gov/DeliveryApps

2022 Report: The State of Workers’ Rights in New York City

The report outlines DCWP’s work during 2021 to protect New Yorkers who performed essential services throughout the COVID-19 pandemic, raise labor standards through new policies, enforce worker protection laws, and educate businesses and workers alike.

Download report

Read press release

The report outlines DCWP’s work during 2021 to protect New Yorkers who performed essential services throughout the COVID-19 pandemic, raise labor standards through new policies, enforce worker protection laws, and educate businesses and workers alike.

Download report

Read press release

Weighed Down: New Yorkers Share How Student Loan Debt Is Affecting Their Lives

DCWP, Columbia Population Research Center (CPRC), and the Center on Poverty and Social Policy (CPSP) released a report that examines who in New York City holds debt, for whom this debt was taken out for, how much they owe, how they are managing their debt, and how their debt affects major life choices, confidence about repayment, and evaluation of their educational decisions.

Download report

Read press release

DCWP, Columbia Population Research Center (CPRC), and the Center on Poverty and Social Policy (CPSP) released a report that examines who in New York City holds debt, for whom this debt was taken out for, how much they owe, how they are managing their debt, and how their debt affects major life choices, confidence about repayment, and evaluation of their educational decisions.

Download report

Read press release

Where Are the Unbanked in NYC? | Updated Findings (2019 Data)

Every two years, DCWP estimates the unbanked in NYC. The research brief illustrates the updated number of unbanked households in NYC (an estimated 301,700 NYC households), details demographic information about the unbanked population, and highlights systemic barriers to banking access.

Download research brief

Read press release

Every two years, DCWP estimates the unbanked in NYC. The research brief illustrates the updated number of unbanked households in NYC (an estimated 301,700 NYC households), details demographic information about the unbanked population, and highlights systemic barriers to banking access.

Download research brief

Read press release

The New Rent-to-Own: More Confusing, Still Expensive, and Offered at an NYC Store Near You

DCWP released a report examining the virtual lease-to-own (LTO) industry in New York City, specifically focusing on those promoted by brick-and mortar businesses, which are predominately located in Black and Hispanic neighborhoods, and the deceptive tactics used to lure consumers into financing agreements.

Download report

Read press release

DCWP released a report examining the virtual lease-to-own (LTO) industry in New York City, specifically focusing on those promoted by brick-and mortar businesses, which are predominately located in Black and Hispanic neighborhoods, and the deceptive tactics used to lure consumers into financing agreements.

Download report

Read press release

2021 Report: The State of Workers' Rights in New York City

DCWP released its fourth annual report on the State of Workers’ Rights in New York City, which highlights our efforts to protect workers and expand City workplace laws during the COVID-19 pandemic.

Download report

Read press release

DCWP released its fourth annual report on the State of Workers’ Rights in New York City, which highlights our efforts to protect workers and expand City workplace laws during the COVID-19 pandemic.

Download report

Read press release

Upwardly Immobile: Low-Income Borrowers and the High Cost of College Education

DCWP released the third in its series of reports on vulnerable student loan borrowers. When compared to higher-income peers, student borrowers from low-income families: are less likely to complete their degree or certificates, earn less, often borrow more and repay their loans at lower rates.

Download report

Read press release

DCWP released the third in its series of reports on vulnerable student loan borrowers. When compared to higher-income peers, student borrowers from low-income families: are less likely to complete their degree or certificates, earn less, often borrow more and repay their loans at lower rates.

Download report

Read press release

Research Identifies Severe Economic Impacts of the Pandemic

DCWP released a research brief examining how COVID-19 is impacting New Yorkers financial health in the short-term and the potential long-term impacts of not immediately addressing the uneven impact of the pandemic economy. This is the second and final brief in the series about the economic effects of the COVID-19 crisis.

Download report

Read press release

DCWP released a research brief examining how COVID-19 is impacting New Yorkers financial health in the short-term and the potential long-term impacts of not immediately addressing the uneven impact of the pandemic economy. This is the second and final brief in the series about the economic effects of the COVID-19 crisis.

Download report

Read press release

Analysis Shows Price Gouging Preys on Vulnerable New Yorkers

Department of Consumer and Worker Protection (DCWP) Commissioner Lorelei Salas today announced that, after analyzing the more than 10,000 complaints about price gouging, the neighborhoods with the most complaints are many of the same neighborhoods that were hardest hit by COVID-19. These neighborhoods, which are majority Black and Hispanic, are already financially vulnerable and, with median household incomes of approximately $30,000, can least afford to be gouged on lifesaving items like face masks, hand sanitizer, and disinfecting wipes.

Download report

Read press release

Department of Consumer and Worker Protection (DCWP) Commissioner Lorelei Salas today announced that, after analyzing the more than 10,000 complaints about price gouging, the neighborhoods with the most complaints are many of the same neighborhoods that were hardest hit by COVID-19. These neighborhoods, which are majority Black and Hispanic, are already financially vulnerable and, with median household incomes of approximately $30,000, can least afford to be gouged on lifesaving items like face masks, hand sanitizer, and disinfecting wipes.

Download report

Read press release

Research Identifies New Yorkers Most Vulnerable to the Economic Effects of the Pandemic

DCWP released a research brief examining the financial vulnerability of New Yorkers prior to the COVID-19 crisis to understand who is least able to cope with its economic effects. The research brief looks at three key indicators of financial health—banking access, emergency savings, and credit access—to identify the most vulnerable neighborhoods prior to the pandemic and who is therefore most vulnerable now and to future economic shocks. The brief finds that the most financially vulnerable New Yorkers live in south and central Bronx, northern Manhattan, and eastern Brooklyn—neighborhoods that also have higher shares of Black and Hispanic households and households with low incomes. This is the first of two briefs about the economic effects of the COVID-19 crisis.

Download report

Read press release

DCWP released a research brief examining the financial vulnerability of New Yorkers prior to the COVID-19 crisis to understand who is least able to cope with its economic effects. The research brief looks at three key indicators of financial health—banking access, emergency savings, and credit access—to identify the most vulnerable neighborhoods prior to the pandemic and who is therefore most vulnerable now and to future economic shocks. The brief finds that the most financially vulnerable New Yorkers live in south and central Bronx, northern Manhattan, and eastern Brooklyn—neighborhoods that also have higher shares of Black and Hispanic households and households with low incomes. This is the first of two briefs about the economic effects of the COVID-19 crisis.

Download report

Read press release

Municipal Policies for Community Wealth Building

As part of its efforts to expand inclusive ownership opportunities, OFE conducted extensive research into initiatives in localities around the country and the world. The report, Municipal Policies for Community Wealth Building, surveys community wealth building strategies that 15 cities and regions in the U.S. and around the world are undertaking to strengthen the economic and financial health of their communities—and how powerful those approaches can be. These strategies are particularly applicable now as the city—and the country and the world—look to recover with a heightened sense of need for equitable systems and policies. The report also categorizes the strategies within the framework of five essential principles that are necessary for successful inclusive ownership policies and programs.

Download report

As part of its efforts to expand inclusive ownership opportunities, OFE conducted extensive research into initiatives in localities around the country and the world. The report, Municipal Policies for Community Wealth Building, surveys community wealth building strategies that 15 cities and regions in the U.S. and around the world are undertaking to strengthen the economic and financial health of their communities—and how powerful those approaches can be. These strategies are particularly applicable now as the city—and the country and the world—look to recover with a heightened sense of need for equitable systems and policies. The report also categorizes the strategies within the framework of five essential principles that are necessary for successful inclusive ownership policies and programs.

Download report

Unequal Burden: Black Borrowers and the Student Loan Debt Crisis

DCWP released a report that explores inequities in borrowing and the connections to the racial wealth gap, school quality and outcomes, and difficulty repaying. Higher education is glorified as a pathway to equal opportunity but often contributes to racial and generational wealth gaps. This is the second in a series of three reports about communities who are most vulnerable to student loan debt and/or are vulnerable to predatory targeting by for-profit schools.

Download report

Read press release

DCWP released a report that explores inequities in borrowing and the connections to the racial wealth gap, school quality and outcomes, and difficulty repaying. Higher education is glorified as a pathway to equal opportunity but often contributes to racial and generational wealth gaps. This is the second in a series of three reports about communities who are most vulnerable to student loan debt and/or are vulnerable to predatory targeting by for-profit schools.

Download report

Read press release

2020 Report: The State of Workers' Rights in New York City

In his 2019 State of the City address, Mayor Bill de Blasio announced that the Department of Consumer Affairs (DCA) would be renamed the Department of Consumer and Worker Protection (DCWP), marking an important milestone in the growth of the Agency. The Agency’s new name better reflects its expanded role and mandate. This report follows two previous publications about The State of Workers’ Rights. It is organized according to DCWP’s four main worker protection functions: Enforcing NYC’s Worker Protection Laws; Educating New Yorkers about Workers’ Rights; Developing New Policies to Raise Labor Standards; and Analyzing NYC’s Labor Markets. Download Third Annual Report on the State of Workers’ Rights in NYC

In his 2019 State of the City address, Mayor Bill de Blasio announced that the Department of Consumer Affairs (DCA) would be renamed the Department of Consumer and Worker Protection (DCWP), marking an important milestone in the growth of the Agency. The Agency’s new name better reflects its expanded role and mandate. This report follows two previous publications about The State of Workers’ Rights. It is organized according to DCWP’s four main worker protection functions: Enforcing NYC’s Worker Protection Laws; Educating New Yorkers about Workers’ Rights; Developing New Policies to Raise Labor Standards; and Analyzing NYC’s Labor Markets. Download Third Annual Report on the State of Workers’ Rights in NYC

Ill-Served: Why NYC Veterans Should Use extra Caution When Choosing a For-Profit School

DCWP released a report that explores the historical relationship between veterans and for-profit institutions, how well for-profit schools serve veterans, and if for-profit schools are a sound investment for veterans looking to pursue higher education. This is the first in what will be a series of reports about communities who are most vulnerable to student loan debt and/or are vulnerable to predatory targeting by for-profit schools.

Download report

Read press release

DCWP released a report that explores the historical relationship between veterans and for-profit institutions, how well for-profit schools serve veterans, and if for-profit schools are a sound investment for veterans looking to pursue higher education. This is the first in what will be a series of reports about communities who are most vulnerable to student loan debt and/or are vulnerable to predatory targeting by for-profit schools.

Download report

Read press release

Lost in Translation: Findings from Examination of Language Access by Debt Collectors

DCWP released a report which highlights the lack of language access services for limited-English proficiency (LEP) consumers by debt collection agencies. Without any laws in place requiring debt collection agencies to offer language access services to consumers, only a minority of collectors do so.

Download report

Read press release

DCWP released a report which highlights the lack of language access services for limited-English proficiency (LEP) consumers by debt collection agencies. Without any laws in place requiring debt collection agencies to offer language access services to consumers, only a minority of collectors do so.

Download report

Read press release

Where Are the Unbanked and Underbanked in NYC?

DCWP released a research brief illustrating the updated number of unbanked and underbanked households in NYC and where they live. The brief shows that 354,100 households (11.2 percent) have no bank account (unbanked) and another 689,000 households (21.8 percent) have a bank account but use alternative financial products for some banking needs (underbanked). The estimated number of unbanked and underbanked households are disproportionately in neighborhoods that have higher rates of vulnerable residents and residents struggling in other areas of financial health. This brief is an update to the 2015 report “Where Are the Unbanked and Underbanked in NYC?”

Download research brief in: English or Español (Spanish)

Read press release

DCWP released a research brief illustrating the updated number of unbanked and underbanked households in NYC and where they live. The brief shows that 354,100 households (11.2 percent) have no bank account (unbanked) and another 689,000 households (21.8 percent) have a bank account but use alternative financial products for some banking needs (underbanked). The estimated number of unbanked and underbanked households are disproportionately in neighborhoods that have higher rates of vulnerable residents and residents struggling in other areas of financial health. This brief is an update to the 2015 report “Where Are the Unbanked and Underbanked in NYC?”

Download research brief in: English or Español (Spanish)

Read press release

Student Loan Debt Distress Across NYC Neighborhoods: Public Hearing and Policy Proposals

On June 20, 2018, DCA Commissioner Lorelei Salas chaired Speak Up, Speak Out: A Public Hearing about Student Loan Debt in NYC. At the hearing, legal service providers, experts in the higher education field, advocates for students and veterans, and members of the public came together to share their experiences with student loan debt. The panelists and attendees also shed light on some of the barriers to successful loan repayment. In this latest report we outline the scale of the student loan debt problem; highlight findings from our previous student loan reports; summarize testimony from the hearing; and offer policy recommendations.

Download report

On June 20, 2018, DCA Commissioner Lorelei Salas chaired Speak Up, Speak Out: A Public Hearing about Student Loan Debt in NYC. At the hearing, legal service providers, experts in the higher education field, advocates for students and veterans, and members of the public came together to share their experiences with student loan debt. The panelists and attendees also shed light on some of the barriers to successful loan repayment. In this latest report we outline the scale of the student loan debt problem; highlight findings from our previous student loan reports; summarize testimony from the hearing; and offer policy recommendations.

Download report

Advances and Setbacks in Turbulent Times: Second Annual Report on the State of Workers' Rights in NYC

Synthesizing testimony from dozens of workers and advocates at DCA’s July 2018 hearing on the State of Workers’ Rights in NYC, the report highlights voids in labor protections experienced by workers across the city, concrete and positive impacts that the City’s workplace laws are having on worker’s jobs and lives, and the strategies DCA deployed in 2018 to make critical progress.

Download report

Read press release

Synthesizing testimony from dozens of workers and advocates at DCA’s July 2018 hearing on the State of Workers’ Rights in NYC, the report highlights voids in labor protections experienced by workers across the city, concrete and positive impacts that the City’s workplace laws are having on worker’s jobs and lives, and the strategies DCA deployed in 2018 to make critical progress.

Download report

Read press release

Student Loan Debt Distress Across NYC Neighborhoods: Identifying Indicators of Vulnerability

In November 2018, OFE announced the findings of their second student loan report which was a follow-up to the previous research report, Student Loan Borrowing Across NYC Neighborhoods, a collaboration between OFE and the Federal Reserve Bank of New York. The report identifies and examines seven factors that are associated with student loan default among New Yorkers, while also highlighting trends across New York City neighborhoods. The seven factors that increase vulnerability to student loan default include: non-completion, part-time attendance, attendance at a for-profit institution, independent student status, low income, and being black or Hispanic.

Download report

Read press release

In November 2018, OFE announced the findings of their second student loan report which was a follow-up to the previous research report, Student Loan Borrowing Across NYC Neighborhoods, a collaboration between OFE and the Federal Reserve Bank of New York. The report identifies and examines seven factors that are associated with student loan default among New Yorkers, while also highlighting trends across New York City neighborhoods. The seven factors that increase vulnerability to student loan default include: non-completion, part-time attendance, attendance at a for-profit institution, independent student status, low income, and being black or Hispanic.

Download report

Read press release

Demanding Rights in an On-Demand Economy: Key Findings from Year One of NYC's Freelance Isn't Free Act

The Freelance Isn’t Free Act, the first law of its kind in the country, took effect on May 15, 2017 – giving freelance workers the legal right to written contracts, timely payment, and freedom from retaliation. In its first year, DCA received 299 inquiries about the law and 264 complaints from freelancers. The most common allegations were for payment violations (98 percent), including late payment and non-payment for services. To date, DCA has assisted freelancers in recovering $254,866 in lost wages. DCA will use the report’s findings to strengthen outreach and education of this critical workplace law to workers and hiring parties alike.

Download report

Read press release

The Freelance Isn’t Free Act, the first law of its kind in the country, took effect on May 15, 2017 – giving freelance workers the legal right to written contracts, timely payment, and freedom from retaliation. In its first year, DCA received 299 inquiries about the law and 264 complaints from freelancers. The most common allegations were for payment violations (98 percent), including late payment and non-payment for services. To date, DCA has assisted freelancers in recovering $254,866 in lost wages. DCA will use the report’s findings to strengthen outreach and education of this critical workplace law to workers and hiring parties alike.

Download report

Read press release

Lifting up Paid Care Work: Year One of New York City's Paid Care Division

DCA’s Office of Labor Policy & Standards (OLPS) houses the Paid Care Division, the only governmental office in the United States charged with raising job standards in care industries. As the Division concludes its first year, this report provides an analysis of what it has learned, an overview of its accomplishments, and a roadmap for action it plans to take in the years to come. Specifically, the report elaborates on the close partnerships the Division has fostered with City agencies, academic institutions, and organizing and advocacy groups. These partnerships have culminated in the adoption of model standards for paid care jobs.

Download report in: English or Español (Spanish)

Read press release

DCA’s Office of Labor Policy & Standards (OLPS) houses the Paid Care Division, the only governmental office in the United States charged with raising job standards in care industries. As the Division concludes its first year, this report provides an analysis of what it has learned, an overview of its accomplishments, and a roadmap for action it plans to take in the years to come. Specifically, the report elaborates on the close partnerships the Division has fostered with City agencies, academic institutions, and organizing and advocacy groups. These partnerships have culminated in the adoption of model standards for paid care jobs.

Download report in: English or Español (Spanish)

Read press release

Making Paid Care Work Visible: Findings from Focus Groups with New York City Home Care Aides, Nannies, and House Cleaners

In partnership with Ruth Milkman of The City University of New York, DCA released the “Making Paid Care Work Visible” report, which, using focus group and survey results, documents the experiences of New York City’s home-based paid care workers in their own words, offering a bottom-up perspective that is often lacking in public policy debates. It makes visible a world of work that is hidden in the household, far from public view, and offers direct access to the concerns of workers whose voices are rarely heard by policymakers or by the wider public.

Download report in: English or Español (Spanish)

Read press release

In partnership with Ruth Milkman of The City University of New York, DCA released the “Making Paid Care Work Visible” report, which, using focus group and survey results, documents the experiences of New York City’s home-based paid care workers in their own words, offering a bottom-up perspective that is often lacking in public policy debates. It makes visible a world of work that is hidden in the household, far from public view, and offers direct access to the concerns of workers whose voices are rarely heard by policymakers or by the wider public.

Download report in: English or Español (Spanish)

Read press release

How Neighborhoods Help New Yorkers Get Ahead: Findings from the Collaborative for Neighborhood Financial Health

DCA released the “How Neighborhoods Help New Yorkers Get Ahead” report, which defines and creates a framework for understanding and addressing how neighborhoods influence the financial health of individual residents. Over the past year, with the support of the Mayor’s Fund to Advance New York City and the Citi Foundation, DCA’s Office of Financial Empowerment (OFE) has undertaken the Collaborative for Neighborhood Financial Health project to engage with New Yorkers at the community level to understand what factors influence a neighborhood’s financial health. OFE engaged hundreds of East Harlem and Bedford-Stuyvesant neighborhood residents and stakeholders in interviews, focus groups, and interactive community workshops to learn more about neighborhood conditions and the ways those conditions support or limit individual financial health.

Download report

DCA released the “How Neighborhoods Help New Yorkers Get Ahead” report, which defines and creates a framework for understanding and addressing how neighborhoods influence the financial health of individual residents. Over the past year, with the support of the Mayor’s Fund to Advance New York City and the Citi Foundation, DCA’s Office of Financial Empowerment (OFE) has undertaken the Collaborative for Neighborhood Financial Health project to engage with New Yorkers at the community level to understand what factors influence a neighborhood’s financial health. OFE engaged hundreds of East Harlem and Bedford-Stuyvesant neighborhood residents and stakeholders in interviews, focus groups, and interactive community workshops to learn more about neighborhood conditions and the ways those conditions support or limit individual financial health.

Download report

Student Loan Borrowing Across NYC Neighborhoods

DCA's Office of Financial Empowerment (OFE) and the Federal Reserve Bank of New York announced the findings of Student Loan Borrowing Across NYC Neighborhoods (the Report), the first neighborhood-level examination of student loan outcomes. The Report’s findings show that although New Yorkers’ delinquency and default rates are slightly lower than the national average, certain NYC neighborhoods are experiencing significantly higher rates of delinquency and default despite the fact that their residents have low average loan balances. These higher levels of student debt delinquency and default also tended to be among older borrowers and those in lower- income neighborhoods.

Download report

Read press release

DCA's Office of Financial Empowerment (OFE) and the Federal Reserve Bank of New York announced the findings of Student Loan Borrowing Across NYC Neighborhoods (the Report), the first neighborhood-level examination of student loan outcomes. The Report’s findings show that although New Yorkers’ delinquency and default rates are slightly lower than the national average, certain NYC neighborhoods are experiencing significantly higher rates of delinquency and default despite the fact that their residents have low average loan balances. These higher levels of student debt delinquency and default also tended to be among older borrowers and those in lower- income neighborhoods.

Download report

Read press release

The State of Workers’ Rights in New York City

DCA's Office of Labor Policy & Standards (OLPS) released a report “The State of Workers’ Rights in New York City,” which details emerging gaps in labor protections and offers policy solutions to these growing concerns. The report summarizes the testimony of 110 workers given during a public hearing in April 2017 that was convened by DCA, in collaboration with the New York City Commission on Human Rights and the Mayor’s Office of Immigrant Affairs (MOIA). Through their testimony, workers articulated the many challenges and concerns facing immigrant, paid care, and contingent workers. Their personal narratives reveal a pattern of egregious workplace violations affecting a diverse range of industries, demonstrating that wage theft, harassment, and discrimination are not limited to low-wage industries, but increasingly pose threats in traditionally higher-paying jobs as well, including writers and academics.

Download report in: English or Español (Spanish)

Read press release announcing release of report

DCA's Office of Labor Policy & Standards (OLPS) released a report “The State of Workers’ Rights in New York City,” which details emerging gaps in labor protections and offers policy solutions to these growing concerns. The report summarizes the testimony of 110 workers given during a public hearing in April 2017 that was convened by DCA, in collaboration with the New York City Commission on Human Rights and the Mayor’s Office of Immigrant Affairs (MOIA). Through their testimony, workers articulated the many challenges and concerns facing immigrant, paid care, and contingent workers. Their personal narratives reveal a pattern of egregious workplace violations affecting a diverse range of industries, demonstrating that wage theft, harassment, and discrimination are not limited to low-wage industries, but increasingly pose threats in traditionally higher-paying jobs as well, including writers and academics.

Download report in: English or Español (Spanish)

Read press release announcing release of report

Working in NYC: Results from the 2017 Empire State Poll

In early 2017, DCA's Office of Labor Policy & Standards (OLPS) and the Worker Institute at Cornell partnered to add a series of questions to the Empire State Poll, a representative phone survey of 800 New York State residents conducted annually by the Cornell Survey Research Institute. The survey questions developed by OLPS and the Worker Institute addressed a range of issues related to inequality, working conditions, and the role of city and local government in protecting immigrants and defending worker rights. The poll results provide useful insight not only into existing problems faced by New York City workers but also the kind of response that New Yorkers would like to see from their City as the national political environment shifts.

Read survey results

In early 2017, DCA's Office of Labor Policy & Standards (OLPS) and the Worker Institute at Cornell partnered to add a series of questions to the Empire State Poll, a representative phone survey of 800 New York State residents conducted annually by the Cornell Survey Research Institute. The survey questions developed by OLPS and the Worker Institute addressed a range of issues related to inequality, working conditions, and the role of city and local government in protecting immigrants and defending worker rights. The poll results provide useful insight not only into existing problems faced by New York City workers but also the kind of response that New Yorkers would like to see from their City as the national political environment shifts.

Read survey results

Leveraging Financial Empowerment to Support Employee-Owned Businesses: Lessons and Tools for Cooperative Developers

DCA’s Office of Financial Empowerment and Make the Road New York, with support from Citi Community Development, partnered with The ICA Group and Dr. Joyce Moy of the City University of New York to explore how employee ownership models can best support worker-owners to improve their financial health and build assets. The report and tools featured are meant to support cooperative developers, employee-owners, and managers in employee-owned businesses in implementing financial empowerment programs inside their workplaces.

Learn more

DCA’s Office of Financial Empowerment and Make the Road New York, with support from Citi Community Development, partnered with The ICA Group and Dr. Joyce Moy of the City University of New York to explore how employee ownership models can best support worker-owners to improve their financial health and build assets. The report and tools featured are meant to support cooperative developers, employee-owners, and managers in employee-owned businesses in implementing financial empowerment programs inside their workplaces.

Learn more

Used and Abused by the Used Car Industry: Predatory Lending in the Secondhand Auto Industry

Department of Consumer Affairs and Council Member Rafael Espinal, Jr. held a public hearing in October 2016 to explore predatory lending in the used car industry. This report provides an overview of the public hearing that includes findings and recommendations

Download report

Read press release

Department of Consumer Affairs and Council Member Rafael Espinal, Jr. held a public hearing in October 2016 to explore predatory lending in the used car industry. This report provides an overview of the public hearing that includes findings and recommendations

Download report

Read press release

Improving Access to Affordable Housing Opportunities

Department of Housing Preservation and Development (HPD) and Department of Consumer Affairs (DCA) released a study on Improving Access to Affordable Housing Opportunities, that explores the experience of affordable housing applicants and recommends ways to further support applicants through an outreach and education strategy that incorporates financial empowerment services. Based on the initial findings of the study, the agencies also released a new guide, Ready, Set, Apply: Getting Ready for Affordable Housing in NYC, available in English and Spanish, to help New Yorkers best prepare for and navigate the housing application process.

Download report

Download Ready, Set, Apply: Getting Ready for Affordable Housing in NYC guide in English or Español (Spanish)

Read press release

Department of Housing Preservation and Development (HPD) and Department of Consumer Affairs (DCA) released a study on Improving Access to Affordable Housing Opportunities, that explores the experience of affordable housing applicants and recommends ways to further support applicants through an outreach and education strategy that incorporates financial empowerment services. Based on the initial findings of the study, the agencies also released a new guide, Ready, Set, Apply: Getting Ready for Affordable Housing in NYC, available in English and Spanish, to help New Yorkers best prepare for and navigate the housing application process.

Download report

Download Ready, Set, Apply: Getting Ready for Affordable Housing in NYC guide in English or Español (Spanish)

Read press release

Ventanilla de Asesoría Financiera: Program Insights for the Field

DCA, Consulate General of Mexico, and Citi released a report on the first year of the Ventanilla de Asesoría Financiera (Financial Empowerment Window), outlining the program's origin, design, implementation, successes, challenges, and lessons learned.

Download report in English or Español (Spanish)

Read press release celebrating the second anniversary of the Ventanilla

DCA, Consulate General of Mexico, and Citi released a report on the first year of the Ventanilla de Asesoría Financiera (Financial Empowerment Window), outlining the program's origin, design, implementation, successes, challenges, and lessons learned.

Download report in English or Español (Spanish)

Read press release celebrating the second anniversary of the Ventanilla

A Study of Gender Pricing in New York City

DCA conducted its first-ever study of the gender pricing of goods in New York City across multiple industries. The industries studied for this report include: toys and accessories, children’s clothing, adult clothing, personal care products, and home health care products for seniors. This study reflects an average consumer lifecycle, from baby to senior products, providing a glimpse into the experiences of consumers of all ages.

Learn more

Share your #GenderPricing examples with us on Twitter

DCA conducted its first-ever study of the gender pricing of goods in New York City across multiple industries. The industries studied for this report include: toys and accessories, children’s clothing, adult clothing, personal care products, and home health care products for seniors. This study reflects an average consumer lifecycle, from baby to senior products, providing a glimpse into the experiences of consumers of all ages.

Learn more

Share your #GenderPricing examples with us on Twitter

DCA Releases First Municipal Study on Mobile Technology & Money Management

In partnership with the Cities for Financial Empowerment Fund (CFE Fund) and with the support of Capital One and MetLife Foundation, the DCA Office of Financial Empowerment commissioned RTI International to conduct this study to analyze the needs, barriers, and opportunities to increase financial inclusion through mobile financial services use. Findings show that New York City is a unique marketplace for mobile banking and money management innovation.

Read New York City Mobile Services Study

View interactive tool depicting data

View infographic highlighting key findings

Interested in exploring mobile financial services for your city? Download toolkit

Share your #MobileBanking experience with us on Twitter

In partnership with the Cities for Financial Empowerment Fund (CFE Fund) and with the support of Capital One and MetLife Foundation, the DCA Office of Financial Empowerment commissioned RTI International to conduct this study to analyze the needs, barriers, and opportunities to increase financial inclusion through mobile financial services use. Findings show that New York City is a unique marketplace for mobile banking and money management innovation.

Read New York City Mobile Services Study

View interactive tool depicting data

View infographic highlighting key findings

Interested in exploring mobile financial services for your city? Download toolkit

Share your #MobileBanking experience with us on Twitter

New Yorkers' Use of Banks and Their Perception of Financial Security

To better understand New Yorkers’ use of banks and sense of financial health and develop more effective future programming and products, DCA’s Office of Financial Empowerment (OFE) commissioned the Urban Institute to prepare studies and develop an accompanying interactive map depicting the data. The research shows 1.14 million households in NYC are unbanked or underbanked; and more than half of New Yorkers don't have adequate savings for an emergency.

Read Where Are the Unbanked and Underbanked in New York City?

Read How Do New Yorkers Perceive Their Financial Security?

View interactive map

To better understand New Yorkers’ use of banks and sense of financial health and develop more effective future programming and products, DCA’s Office of Financial Empowerment (OFE) commissioned the Urban Institute to prepare studies and develop an accompanying interactive map depicting the data. The research shows 1.14 million households in NYC are unbanked or underbanked; and more than half of New Yorkers don't have adequate savings for an emergency.

Read Where Are the Unbanked and Underbanked in New York City?

Read How Do New Yorkers Perceive Their Financial Security?

View interactive map

NYC's Paid Sick Leave Law: First Year Milestones

New York City’s Earned Sick Time Act (Paid Sick Leave Law) created the legal right to sick leave for 3.4 million private and nonprofit sector workers. For one third of those workers—nearly 1.2 million—the Paid Sick Leave Law (PSL) marked the first time they had access to this vital workplace benefit. This report commemorates the anniversary of the implementation of PSL on April 1, 2014 and focuses on first year milestones.

Download report

New York City’s Earned Sick Time Act (Paid Sick Leave Law) created the legal right to sick leave for 3.4 million private and nonprofit sector workers. For one third of those workers—nearly 1.2 million—the Paid Sick Leave Law (PSL) marked the first time they had access to this vital workplace benefit. This report commemorates the anniversary of the implementation of PSL on April 1, 2014 and focuses on first year milestones.

Download report

Building Financial Counseling into Social Service Delivery: Research and Implementation Findings for Social Service Programs

This report details the work of our Capacity Building Initiative, supported by the Citi Foundation, which funded five nonprofit organizations to provide financial counseling to their clients - who included formerly incarcerated adults, foster care youth, young adult interns, young fathers, and workforce development clients. Initial findings indicate that individuals in workforce development programs who received financial counseling achieved better outcomes than comparison group clients who did not receive financial counseling.

Download report

This report details the work of our Capacity Building Initiative, supported by the Citi Foundation, which funded five nonprofit organizations to provide financial counseling to their clients - who included formerly incarcerated adults, foster care youth, young adult interns, young fathers, and workforce development clients. Initial findings indicate that individuals in workforce development programs who received financial counseling achieved better outcomes than comparison group clients who did not receive financial counseling.

Download report

Virtual VITA: Expanding Free Tax Preparation

The research brief details New York City's experience integrating Virtual Volunteer Income Tax Assistance (VITA) at two NYC Head Start programs in 2013. The Virtual VITA model uses technology to connect a filer with an off-site VITA tax preparer and has enormous potential to expand free tax preparation services at incredibly low cost.

Download brief

The research brief details New York City's experience integrating Virtual Volunteer Income Tax Assistance (VITA) at two NYC Head Start programs in 2013. The Virtual VITA model uses technology to connect a filer with an off-site VITA tax preparer and has enormous potential to expand free tax preparation services at incredibly low cost.

Download brief

NYC Department of Consumer Affairs Office of Financial Empowerment: Progress Report, 2010-2013

Covering the years 2010 through 2013, OFE's progress report details our work - both locally and nationally through replication efforts - developing, implementing, testing, and integrating programs and products in four critical areas: Financial counseling and education; Access to banking; Asset building; Consumer protection.

Download report

Covering the years 2010 through 2013, OFE's progress report details our work - both locally and nationally through replication efforts - developing, implementing, testing, and integrating programs and products in four critical areas: Financial counseling and education; Access to banking; Asset building; Consumer protection.

Download report

Municipal Financial Empowerment: A Supervitamin for Public Programs

The report series builds the case that fully integrating financial empowerment and asset building strategies into public programs will lead to more effective service delivery, improving outcomes while potentially saving money.

• Download Strategy #5: Integrating Asset Building

• Download Strategy #4: Targeting Consumer Financial Protection Powers

• Download Strategy #3: Integrating Safe and Affordable Bank Accounts

• Download Strategy #2: Professionalizing the Field of Financial Education and Counseling

• Download Strategy #1: Integrating Professional Financial Counseling

The report series builds the case that fully integrating financial empowerment and asset building strategies into public programs will lead to more effective service delivery, improving outcomes while potentially saving money.

• Download Strategy #5: Integrating Asset Building

• Download Strategy #4: Targeting Consumer Financial Protection Powers

• Download Strategy #3: Integrating Safe and Affordable Bank Accounts

• Download Strategy #2: Professionalizing the Field of Financial Education and Counseling

• Download Strategy #1: Integrating Professional Financial Counseling

Immigrant Financial Services Study

Released November 2013, the Study is one of the first field research initiatives in New York City to look specifically at the financial needs and practices of recent immigrants. The full report is a comprehensive overview of the data, analysis, and key findings.

Download full report

Download Research Brief in:

• English

• Español (Spanish)

• 中文 (Chinese)

Released November 2013, the Study is one of the first field research initiatives in New York City to look specifically at the financial needs and practices of recent immigrants. The full report is a comprehensive overview of the data, analysis, and key findings.

Download full report

Download Research Brief in:

• English

• Español (Spanish)

• 中文 (Chinese)

New York City Financial Empowerment Conference: Showcasing Partner Innovations in the Field

Prepared for the October 2013 NYC Financial Empowerment Conference, the compendium includes papers from over 20 partner organizations detailing the innovative ways they are helping to financially empower New Yorkers.

Download the compendium

Prepared for the October 2013 NYC Financial Empowerment Conference, the compendium includes papers from over 20 partner organizations detailing the innovative ways they are helping to financially empower New Yorkers.

Download the compendium

SaveUSA Program Brief

SaveUSA is a tax time matched savings program designed to encourage short-term savings among tax filers with low to moderate incomes. This brief documents Year 1 of the national replication of the program in 2011, with a focus on key implementation lessons for policymakers, advocates, and funders to highlight tax time savings in their work and provide a framework for further replication.

Download the brief

SaveUSA is a tax time matched savings program designed to encourage short-term savings among tax filers with low to moderate incomes. This brief documents Year 1 of the national replication of the program in 2011, with a focus on key implementation lessons for policymakers, advocates, and funders to highlight tax time savings in their work and provide a framework for further replication.

Download the brief

Citywide Financial Services Study

The Study quantified for the first time the number of unbanked adults in New York City (825,000).

Download Findings

Download Financial Environment presentation

Download methodology

Download banking profiles for each community district

Download credit and debt profiles for each community district

The Study quantified for the first time the number of unbanked adults in New York City (825,000).

Download Findings

Download Financial Environment presentation

Download methodology

Download banking profiles for each community district

Download credit and debt profiles for each community district

NYC Department of Consumer Affairs Office of Financial Empowerment: Progress Report on the First Three Years, 2006-2009

The report describes the multitude of financial empowerment innovations, strategies, and approaches OFE has implemented thus far—and the national implications for its work, which include building the new field of municipal financial empowerment and founding the Cities for Financial Empowerment (CFE) Coalition.

Download report

The report describes the multitude of financial empowerment innovations, strategies, and approaches OFE has implemented thus far—and the national implications for its work, which include building the new field of municipal financial empowerment and founding the Cities for Financial Empowerment (CFE) Coalition.

Download report

$aveNYC Account Innovation in Asset Building: Research Brief and Update

The $aveNYC Account program is a special savings account to help low income New Yorkers make the most of their tax refund by building savings through a privately funded City matching program. DCA's research explores key asset-building questions.

•Download the Research Update

•Download the Research Brief

The $aveNYC Account program is a special savings account to help low income New Yorkers make the most of their tax refund by building savings through a privately funded City matching program. DCA's research explores key asset-building questions.

•Download the Research Update

•Download the Research Brief

Neighborhood Financial Services Study

The Study examines residents' attitudes and behaviors related to basic banking services, savings, and credit, and the role of financial education in two New York City neighborhoods: Jamaica, Queens and Melrose, Bronx. The purpose of the study is to understand better the banking dynamics in low-income neighborhoods to identify public and private opportunities for long-term, high-impact financial empowerment initiatives.

• Download Executive Summary

• Download Full Report

The Study examines residents' attitudes and behaviors related to basic banking services, savings, and credit, and the role of financial education in two New York City neighborhoods: Jamaica, Queens and Melrose, Bronx. The purpose of the study is to understand better the banking dynamics in low-income neighborhoods to identify public and private opportunities for long-term, high-impact financial empowerment initiatives.

• Download Executive Summary

• Download Full Report