Emergency Management311

Emergency Management311 Search all NYC.gov websites

Search all NYC.gov websites

Insurance

Imagine if all of your belongings went up in flames – how would you pay to replace it all?

Many renters assume that in case of an emergency like a fire or flood, their landlord's insurance would protect them. However, the building's insurance policy only protects the structure.

Renters insurance can help in case of an emergency.

This means that in the case of a disaster like a fire, renters without insurance would need to use their own funds to replace or repair any damages to your things and find a place to stay until repairs are done – a cost that can add up to be thousands of dollars.

There are many different kinds of insurance that cover different things. In addition to renters' insurance, there is also flood insurance and homeowners insurance. You can learn more about these policies and organizations that may help you.

Click a topic, or press the enter key on a topic, to reveal its answer.

Renters Insurance

A basic renters insurance policy typically includes the following coverage:

- Your belongings

- Insurance can help pay to replace damaged or stolen belongings.

- Think about the cost of your electronics, furniture, and clothes. The amount can add up quickly!

- Some policies will even pay if your belongings were stolen while outside the home.

- This can include a bicycle.

- Loss of Use

- If you can't live in your apartment after an emergency (like a fire), insurance may pay for you to stay with friends or in a hotel.

- Most emergencies are too small to qualify for emergency benefits. When the City can provide a hotel room, a stay only lasts for a few days.

- Liability

- If someone is hurt on your property, your insurance policy may help you cover the legal costs.

- Endorsements

- Extra coverage on top of a general policy is called an endorsement.

- If you can't live in your apartment after an emergency (like a fire), insurance may pay for you to stay with friends or in a hotel.

- Insurance can help pay to replace damaged or stolen belongings.

- If you own expensive jewelry, electronics, clothing, family heirlooms, or other expensive things, it can be worth asking about endorsements to protect these items specifically. A general policy might not cover the cost to replace these specialty items.

It is important to understand your policy specifically to see what is covered before you purchase any kind of coverage

Most policies require you to pay a deductible first. This means the amount you will pay out of pocket before the insurance company will pay.

Most people can expect to pay between $10 and $30 per month for a typical renters insurance policy. The best practice is to get quotes from three or more insurance brokers to compare prices.

Read our renters insurance guide (also included under Insurance Resources Below) for more details about a renters insurance policy.

Flood Insurance

Flood damage is not included in renters or homeowners insurance policies.

FEMA estimates that just one inch of water in your home can cause $25,000 worth of damage. Are you protected?

Having flood insurance can save you a lot of money. Nationally, the average National Flood Insurance Program (NFIP) payout is $66,000. The average FEMA disaster individual assistance award is $3,000 (Note that these are national figures and represent averages from 2016 and 2022. Source: FEMA). That's a big difference!

NFIP provides most flood insurance policies. NFIP is a federal program run by the Federal Emergency Management Agency (FEMA). Flood insurance through the NFIP is available for homeowners, renters, and businesses. There are also contents-only policies available for renters under FEMA's NFIP. If you live in a floodplain, you may be required to have flood insurance, but all New Yorkers are eligible for NFIP, no matter what neighborhood you live in.

- To learn more about flood insurance, visit FloodHelpNY.org.

Check out FloodHelpNY's guide to getting the best insurance policy for you:

https://www.floodhelpny.org/en/shopping-for-flood-insurance

You can buy an NFIP policy no matter where you live in NYC. It doesn't matter how many times your home, apartment or business has been flooded. You are still eligible to purchase flood insurance in NYC.

Wherever it can rain, it can flood. Even if you live in an area that is not flood-prone, it's a good idea to have flood insurance.

As climate change brings rising sea levels and more intense storms, areas of NYC that didn't typically flood in the past are now at risk. People outside of high-risk areas file more than 40% of NFIP claims and receive one-third of disaster assistance for flooding.

- Use the NYC Hazard Mitigation Plan's Community Risk Assessment Dashboard to understand your neighborhood's risks from different types of flooding.

- A new law requires landlords to inform tenants about a home's flood history. Home sellers also have to inform prospective buyers about past flooding. Ask about your home's flood history today.

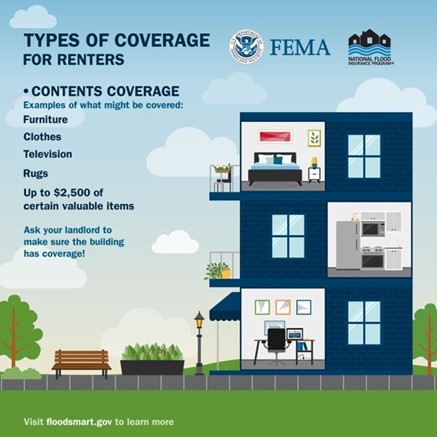

Flood insurance can include the following coverage:

- Building coverage (available for homeowners)

- Only includes coverage for your building's structure.

- Does not include coverage for your belongings, landscaping, or finished basements.

- Contents coverage (available for renters and homeowners)

- Provides coverage for your belongings.

- If you're a renter, flood insurance can offer financial protection in case of a flood.

- Renters' insurance does not cover most flooding damage.

- The NFIP offers coverage for personal belongings (called Contents Coverage) up to $100,000 for renters.

- Does not typically provide coverage for belongings in your basement or lowest floor.

- Provides coverage for your belongings.

- For an NFIP policy quote visit, www.floodsmart.gov/policy-quote/

Work with your broker to determine what coverage and how much coverage you should have.

You might also be required to have flood insurance:

- If you live in a flood zone and have a federally backed mortgage

- If you received federal disaster assistance for flood damage

For more information about flood insurance, see the resources and FAQ sections.

Insurance Resources

Renters Insurance

- Download our Renters Insurance Guide for additional information about renters insurance.

- Neighborhood Housing Services (NHS) has services in each borough. NHS offers resources including webinars and housing counselors that can provide information about renters insurance, including how to sign up and how to understand and optimize your policy, among other topics. Find the location for your borough:

Flood Insurance

- FloodHelpNY offers information about flood risk, flood insurance, and flood retrofits, as well as other resources. Visit FloodHelpNY.org to learn more.

- FEMA runs the National Flood Insurance Program (NFIP). FEMA offers a number of resources related to NFIP and general flooding preparedness. Learn more about NFIP and how it can benefit you: https://www.floodsmart.gov/

- Learn more about flood insurance by speaking with an NYC-based nonprofit:

- Neighborhood Housing Services (NHS) offers resources including webinars and housing counselors that can provide information about insurance and other topics, whether you are a renter, homeowner, or landlord. Find the location for your NHS Organization:

- Center for New York City Neighborhoods (CNYCN) provides information and support for homeowners in NYS Department of Financial Services, including information about flood insurance. Visit https://cnycn.org/ to learn more.

Frequently Asked Questions about Insurance

Renters Insurance

Question: How much can I expect to pay for insurance?

Answer: Most people pay around $10-$30 per month for renters' insurance. Remember to speak to several brokers before committing so that you can get the best policy at the best price.

Question: I don't know where to start getting a policy that's right for me. Where can I get more information and support?

Answer: While NYC Emergency Management does not refer individuals to specific insurance providers, our Insurance Resources section lists partner organizations that will help you find the right policy at the right price.

Flood Insurance

Question: Will my homeowners or renters' insurance cover flooding damage?

Answer: Homeowners and renters' insurance policies don't cover most flood damage.

Your homeowners or renters' policy may offer an optional policy to protect you from sewage backups. Check with your policy provider to see if this is an option.

Get flood insurance and homeowners or renters' insurance to make sure you're protected.

Question: If I'm a renter, can I still get flood insurance?

Answer: The NFIP offers coverage for personal belongings, called contents coverage, which can insure renters' personal property from flood damage.

Contents coverage for a renter is separate from a flood insurance policy that a landlord might have to cover a building.

The limit for contents coverage on all residential buildings is $100,000.

Question: How much can I expect to pay for insurance?

Answer: Flood insurance premiums will be different depending on your flood risk and if your home has flooded before. While sometimes brokers can make mistakes in their quotes, typically you will only need to get one quote for flood insurance, since most plans are offered through the NFIP. For more information, visit FloodHelpNY.org.

Question: I've heard that not all New Yorkers can get flood insurance. Is this true?

Answer: You can buy an NFIP policy no matter where you live in NYC.

It doesn't matter how many times your home, apartment or business has been flooded. You are still eligible to purchase flood insurance in NYC.

Where it can rain, it can flood. Even if you live in an area that is not flood-prone, it's advisable to have flood insurance.

People outside of high-risk areas file more than 40% of NFIP claims and receive one-third of disaster assistance for flooding.

If your building was designated as a repetitive loss or severe repetitive loss due to multiple floodings in the past, those categories will also be transferred because they are designations related to the property. Ask your seller about their flood history and their flood insurance policy.

Question: Will personal property in my basement be covered under NFIP?

Answer: Not everything in your basement is covered under the NFIP.

The NFIP defines a basement as any area of a building with a floor that is below the ground level on all sides.

Basement coverage under an NFIP policy includes cleanup expenses and items used to service the building such as elevators, furnaces, hot water heaters, washers and dryers, air conditioners, freezers, utility connections, circuit breaker boxes, pumps, and tanks used in solar energy systems.

The NFIP does not cover personal property kept in basements or improvements such as finished walls, floors and ceilings.

Question: I don't know where to start getting a policy that's right for me. Where can I get more information and support?

Answer: While NYC Emergency Management does not refer individuals to specific insurance providers, the Insurance Resources Section lists partner organizations that will help you find the right policy.